crypto tax accountant australia

Call 0402 882 075 to speak to a crypto tax agent in Melbourne today. Valles cryptocurrency tax consultants have been involved in the cryptocurrency space since late 2015.

Cryptocurrency Tax Accountants Koinly

Fullstack is an award-winning cryptocurrency accounting advisory firm in Australia specialising in bitcoin crypto tax returns.

. Submit the afore-mentioned information today to obtain your tailored quote. Founder Bitcoin Brisbane. Cryptocurrency tax returns generally start from 2500.

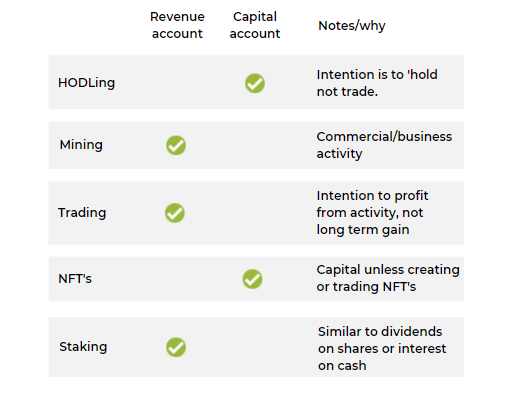

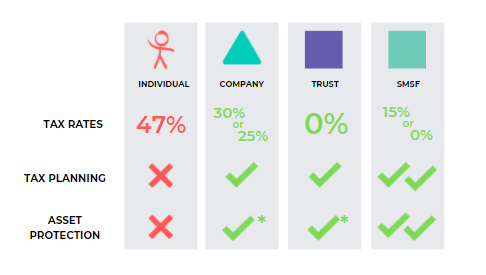

You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction and your individual circumstances. Transcript of Interview with The Crypto Accountant. The Australian Tax Office has issued guidance on how to treat your crypto transactions and if you are not sure whether the tax rules apply to your situation or if you want help filing taxes for then the Box Advisory Services cryptocurrency accountants can help.

MODH is a leading crypto consulting firm in Melbourne advocating on various crypto tax matters and general Cryptocurrency knowledge Australia-wide. Bitcoin Brisbane is one of the first crypto companies in Brisbane and we have used Kova Tax for accounting and tax matters. Suite 2641 Barratt Street Hurstville NSW 2220 Australia.

The ATO says crypto investors need to declare their crypto capital gains or losses as well as any income from crypto in their annual tax return due on the 31st of October 2022. 200 per report payment upfront by credit card or direct debit. Joe David is the founder and managing director of UK-based Nephos Group which helps businesses with tax technology and business planning.

Get an accurate tax report for your Bitcoin and cryptocurrency assets from Australias award winning cryptocurrency tax accountants About Crypto Tax Plus Crypto Tax Plus provides online personalised accurate and practical crypto related tax services to investors trader and enthusiasts alike. We are Australias GO-TO Cryptocurrency Tax Accountants and it will be our pleasure for you to use our service and benefit from our unique systems and knowledge. Find out how the team of Gold Coast tax accountants at Crest can help you with your crypto tax through the information provided below.

Holding cryptocurrency for more than 12 months. Weve dedicated considerable resources to build this website so you can come and learn the basic Australian tax issues associated with cryptocurrency and blockchain. ABAS accountant is Sydneys Leading Tax Accountant for All Cryptocurrencies Tax Advice.

Disposing of cryptocurrency purchased with fiat currency a currency established by a countrys government regulation or law Tim purchased 400 USD Tether USDT for A800. An individual using a cryptocurrency is defined as someone who originally purchased the cryptocurrency as a way to buy goods and services for their own personal consumption. With some guidelines provided by the Australian Taxation Office you wont be subject to income tax for any increase on the value of the cryptocurrency.

It is unlike the unsolicited tax advisory institute you can find randomly. Crypto Tax Calculator Australia offers package deals with SMSF Accountants or accounting firms as a whole. 8500 upfront for 50 reports and 185 per report thereafter.

Cryptocurrency Tax Accountants in Australia. Call 1300 887 627. As an expert cryptocurrency accountant we understand a great deal more than your average CPA when it comes to.

Cryptocurrency Accountants or Munros Cryptocurrency Accountants is a seasoned 45 years old accounting firm that provides tax and business advisory in the state of Australia. For example you might need to pay capital gains on profits from buying and selling cryptocurrency or pay income tax on interest earned when holding crypto. Solves Crypto Tax Specialist is a Chartered Accountant with 12 years experience in Big 4 tax consulting who advises crypto investors traders and businesses using Koinly.

No expiry date on the use of the first 50 reports. How is crypto tax calculated in Australia. The normal capital gains rules apply such as the 50 Capital Gains Tax CGT on the net capital gain for cryptocurrency held for more than 12 months.

From reporting to more complex crypto and tax advice Kova Tax always is happy to chat and discuss. During this time our cryptocurrency tax consultants assisted many of the local Australian ICOs through. Are you looking for reliable crypto tax accountant in Australia.

Beartax can track your trades help you calculate whats owed and generate tax reports. If youre totally lost when it comes to what you need to include in your crypto tax report -. CEO Co-Founder of Flex Dapps.

This industry leading software allows you to connect over 4200 cryptocurrencies all over the world. Bitcoin crypto tax accountant We were one of the first accounting firms in Brisbane to offer crypto accountant services and that is because we are passionate users and investors of digital currency and blockchain technology ourselves. Our cryptocurrency accountants in Sydney Melbourne and Brisbane endured the crypto rollercoaster through the highs of 2017.

But the actual tax accountancy surrounding bitcoin and other crypto comes into play when youre using that digital money on the market to invest grow your business or increase your personal wealth in any way. Only capital gains you make from disposing of personal use assets acquired for less than 10000 are disregarded for capital gains tax purposes. We have a specialist crypto team that helps manage advise on all cryptocurrency tax matters.

US200 unlimited. We provide a full range of Accounting CFO and tax services for individuals and businesses. Supports all major exchanges.

Nephos includes Myna Accountants which is the UKs leading dedicated cryptocurrency accountancy. Our cryptocurrency tax accountants provide professional crypto tax advice and accounting service. Taxbit cryptocurrency tax software developed by leading blockchain CPAs and crypto tax attorneys in Australia.

With the ATO cracking down on crypto in a big way youll need to make sure youre paying all the necessary tax on your bitcoin. Munros is an almost 50-year-old accounting firm operating out of Perth assisting people all across Australia with their tax and business advisory needs.

Be A Tax Accountant By Https Markwhtie Deviantart Com On Deviantart Tax Accountant Accounting Tax

Cryptocurrency Tax Accountant Inspire Ca

Cryptocurrency Tax Accountant Inspire Ca

Finance Vs Accounting Which One Gives A Better Career Finance Accounting Tax Refund

Cryptocurrency Tax Accountant Inspire Ca

Tax Tips On Bitcoin Crypto In Australia 2021 Specialist Cryptocurrency Tax Accountant Q A Youtube

Crypto Tax Tips Australia 2021 Crypto Tax Accountant Q A Youtube

How To Attract Cryptocurrency Investors To Your Accountancy Firm Koinly

The Future Of Accounting Demand And Evolving Technology

Cryptocurrency Tax Accountants Koinly

Crypto Tax Reporting Tools For Accountants Koinly

Crypto Tax In Australia The Definitive 2021 2022 Guide

Cryptocurrency Tax Accountant Inspire Ca

Make The Most Of Your Marketing Department S Meetings Accounting Services Marketing Department Accounting

How Is Crypto Taxed The Accountant S Guide Koinly

3 Questions You Should Ask Your Tax Accountant

Top 10 Crypto Tax Accountants In Australia Crypto News Au

Tax Return Melbourne Tax Return Tax Services Income Tax Return

5 Best Financial Planners In Canberra Top Rated Financial Planners Financial Planner Small Business Tax Investing